Optimize Your Financial Health

As we enter the fourth week of Financial Literacy Month in British Columbia, it’s a perfect time moment to reflect on our financial health and the strides we’ve made this month to take control of our finances.

Whether you’ve delved deep into understanding your finances or are just beginning to explore financial literacy, consistently seeking ways to enhance your financial well-being is a worthwhile journey to undertake.

So, grab a cup of your favorite brew, settle into a comfy chair, and let’s dive into the world of managing your money for a brighter financial future.

Understanding Financial Literacy

Financial literacy is the cornerstone of a strong financial foundation. It’s not just about knowing how to budget or saving for a rainy day; it’s a holistic understanding of how money works in our lives. As we celebrate Financial Literacy Month, it’s essential to recognize the power that knowledge holds in shaping our financial futures. The more we know, the better equipped we are to make informed decisions and navigate the ever-changing landscape of personal finance.

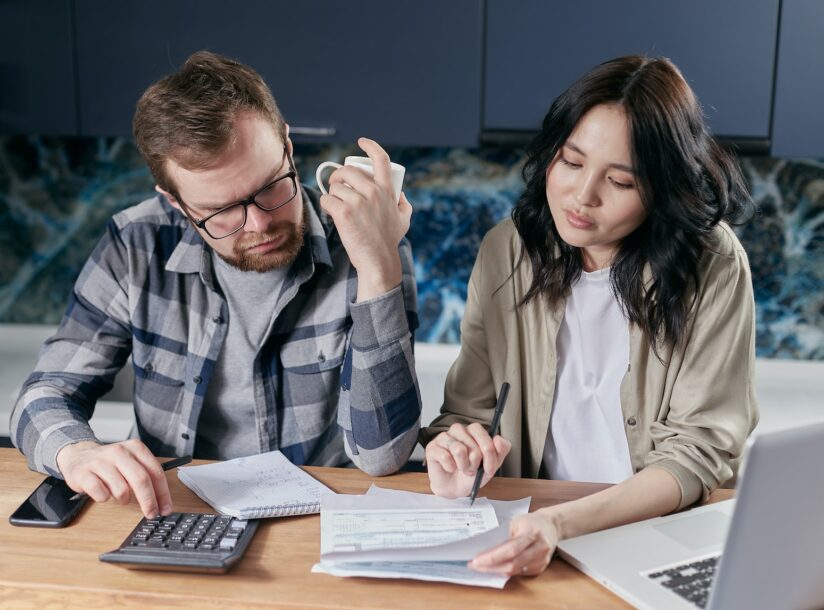

Steps to Optimize Your Financial Health

This week, our focus is on optimizing our financial health. Think of it as a tune-up for your financial engine, ensuring it runs smoothly and efficiently. From managing debt to building savings, there are various steps you can take to enhance your financial well-being.

1. Create a Budget that Works for You

A budget is like a roadmap for your money. It helps you allocate funds to essential expenses, savings, and even a little bit of fun. Take some time to review your current budget or create a budget if you haven’t already. Consider your income, fixed expenses, and discretionary spending. Fine-tune your budget to reflect your financial goals and priorities.

2. Tackle Your Debt Strategically

Carrying a lot of debt can be incredibly stressful but with a strategic approach, you can overcome it. Identify high-interest debts and focus on paying them down first. Explore debt consolidation options in BC or negotiate with creditors to potentially reduce interest rates. By taking proactive steps to manage and reduce debt, you free up more of your income for saving and investing.

3. Build & Protect Your Credit

Your credit score is one important aspect of your financial health. It influences your ability to borrow, and the interest rates you receive. Regularly check your credit report for errors and take steps to improve your score if needed. Pay bills on time, keep credit card balances low, and avoid opening too many new accounts. A healthy credit score opens doors to better financial opportunities.

4. An Emergency Fund is Essential

Like we discussed last week, life is unpredictable, and having an emergency fund is like having a financial safety net. Aim to have at least three to six months’ worth of living expenses saved in an easily accessible account. This fund can help you weather unexpected expenses without derailing your long-term financial goals.

5. Invest in Your Future

Building wealth requires a combination of saving and investing. Review your retirement accounts, such as RRSPs, and consider increasing your contributions. Explore investment options that align with your risk tolerance and financial goals. Investing early and consistently can significantly impact your long-term financial well-being.

6. Continued Education & Resources

Financial literacy is an ongoing journey. Take advantage of educational resources, workshops, and online courses to expand your financial knowledge. The Financial Consumer Agency of Canada has some excellent financial tools and calculators to help you stay informed and make sound financial decisions.

As we begin to wrap up Financial Literacy Month in BC, let’s celebrate the progress we’ve made in optimizing our financial health. Whether you’ve taken the first steps or are well on your way to financial mastery, every effort counts.

Remember, financial well-being is not a destination but a continuous journey. By managing your money wisely, you’re investing in a future of financial stability and peace of mind. So, here’s to you for taking control of your finances and building your knowledge during Financial Literacy Month.