Licensed Insolvency Trustee (LIT)

There are numerous companies that offer credit counselling and debt consolidation services. However, only a Licensed Insolvency Trustee is authorized to provide these services, as well as administer consumer proposals and bankruptcies.

Get a Fresh Financial Start

Book your free consultation with a Licensed Insolvency Trustee today. Our team offers phone and video consultations, allowing you to start your journey to becoming debt-free from the comfort of your home.

"*" indicates required fields

Overview

A Licensed Insolvency Trustee (LIT) is a highly trained and educated professional whose primary role is to ensure that your and your creditors’ rights are maintained throughout the bankruptcy or consumer proposal process.

In Canada, a Licensed Insolvency Trustee is licensed and regulated by the federal government and will work with you to help determine the best debt relief option for your situation.

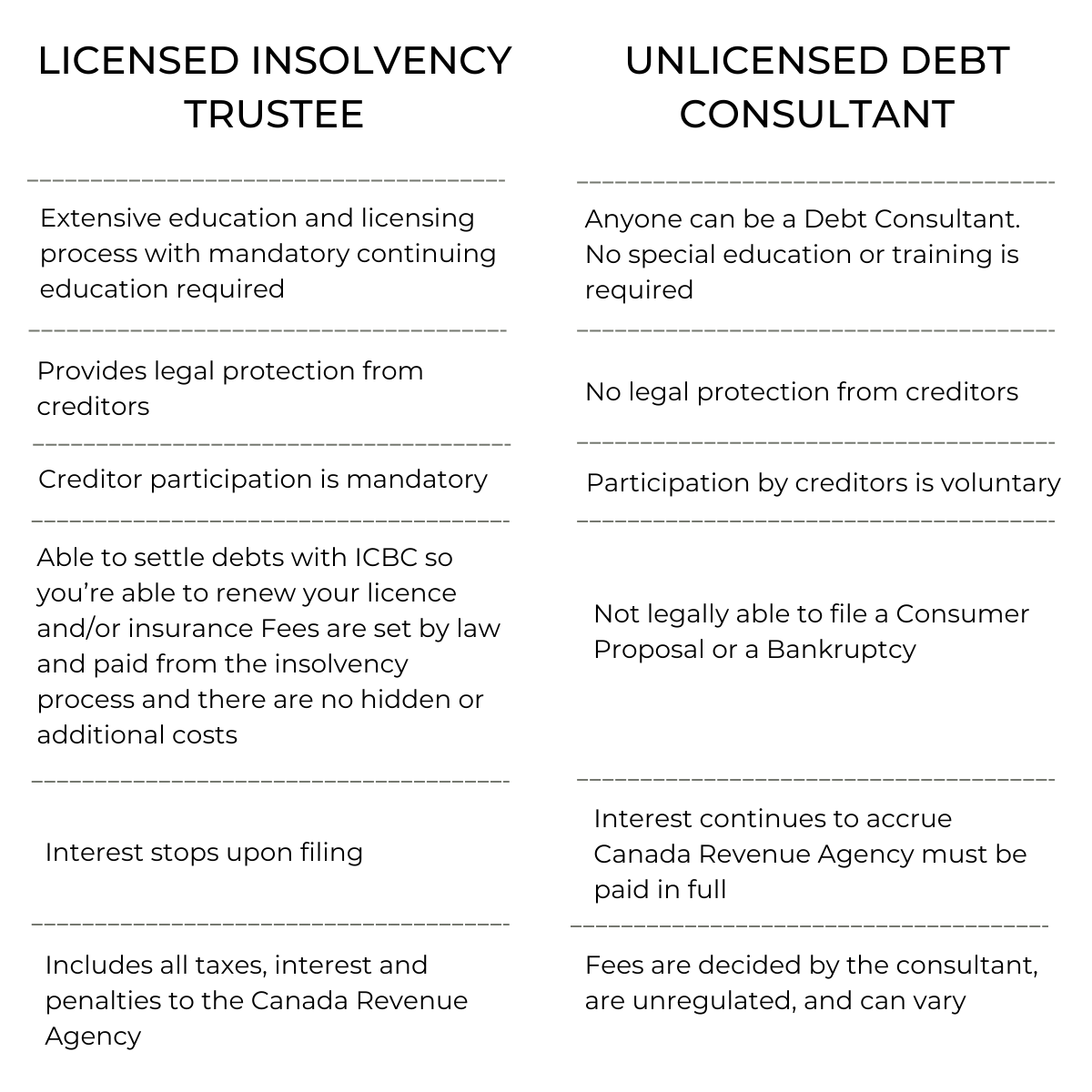

Licensed Insolvency Trustees must abide by a strict code of ethics and conduct. They are required to explain all of your debt-relief options and help you choose the best option for your situation. Other unlicensed debt consultants are not required to abide by these same regulations.

Why a Licensed Insolvency Trustee? Why Should I Work with a Licensed Insolvency Trustee?

A Licensed Insolvency Trustee (LIT) is a professional regulated by the federal government who specializes in helping individuals and businesses overcome serious debt issues.

It’s time to consider working with an LIT if:

- You are overwhelmed by debt and unable to keep up with payments.

- Creditors are calling or threatening legal action.

- You are looking for a legal and regulated solution to address your debt.

- You need guidance on managing your finances and exploring options like consumer proposals or bankruptcy.

An LIT can help you understand your financial situation and guide you toward the best solution for your unique circumstances.

What Does a Licensed Insolvency Trustee Do for Me?

A Licensed Insolvency Trustee provides a range of services to help you manage and resolve your debt issues.

Assessment of Financial Situation: An LIT will review your financial situation, including your assets, liabilities, income, and expenses.

Debt Relief Options: They will explain the options available to you, such as making a consumer proposal, filing for bankruptcy, or other debt relief solutions.

Consumer Proposal: If appropriate, an LIT can help you develop a consumer proposal to offer to your creditors, which includes a reduced, interest-free payment over a longer period.

Bankruptcy Administration: If bankruptcy is the best option, an LIT will administer the process, including filing paperwork and managing creditor meetings.

Financial Counselling: They provide guidance on budgeting, financial management, planning for your financial future, and rebuilding credit.

The Role of an LIT A Licensed Insolvency Trustee’s Role in a Consumer Proposal

In a consumer proposal, your Licensed Insolvency Trustee acts as an intermediary between you and your creditors:

Preparation: The Insolvency Trustee will help you prepare a proposal outlining how much you can afford to pay back to your creditors.

Negotiation: They will submit the proposal to your creditors and negotiate terms on your behalf.

Administration: The trustee manages all administrative aspects, including collecting payments from you and distributing them to your creditors.

Support: Throughout the process, the License Insolvency Trustee provides ongoing support and counselling to ensure you stay on track throughout your consumer proposal.

A Licensed Insolvency Trustee’s Role in a Bankruptcy

If you decide that filing for bankruptcy is the best option for your financial situation, a Licensed Insolvency Trustee plays a crucial role in the process:

Filing for Bankruptcy: The Licensed Trustee handles all necessary paperwork and filings to start the bankruptcy process.

Asset Management: They assess your assets and determine which ones you can keep and which need to be sold to pay creditors.

Creditor Communication: The Bankruptcy Trustee communicates with your creditors on your behalf, arranging meetings and resolving disputes.

Discharge: They ensure you meet all requirements for discharge from bankruptcy, helping you get a fresh financial start.

Counselling: The Licensed Insolvency Trustee provides mandatory financial counselling sessions to help you rebuild your financial health post-bankruptcy.

How Does a Licensed Insolvency Trustee Get Paid?

In a consumer proposal, the fees for a Licensed Insolvency Trustee are set and regulated by the government.

LITs cannot set their own fees and rates. There are no hourly fees for trustee’s services, which means you won’t get an invoice every time you call with a question or a concern.

Typically, the LIT’s fees are included in the proposal payments you make. This means you do not pay the trustee directly out of pocket. Instead, your creditors agree to accept a reduced amount to allow for the licensed trustee’s fees, making it easier for you to manage the cost of the process.

Insolvency vs. Bankruptcy Trustees Are Bankruptcy Trustees and Insolvency Trustees the Same?

Bankruptcy Trustees and Licensed Insolvency Trustees are both commonly used terms to describe a licensed debt professional. However, late in 2015 the Office of the Superintendent of Bankruptcy (OSB) announced that a new title, Licensed Insolvency Trustee (LIT), would replace the Bankruptcy Trustee title in the context of consumer insolvencies.

The name was changed by the OSB in order to better protect against the misuse of the title designation, especially by unlicensed providers. Using the term “licensed” more accurately defines the position, given the amount of education and training as well as the strict code of ethics and rules of professional conduct.

Finally, replacing the term “bankruptcy” with “insolvency” is more inclusive, indicating to consumers that Trustees offer more than just bankruptcy services. Licensed Trustees also administer Consumer Proposals, among other debt-relief services.

Discussing Your Options

The Importance of Working With a LIT

Here are just some of the differences between Licensed Insolvency Trustees and Unlicensed Debt Consultants.