How to Stop Collection Calls and Harassment from Creditors

What’s more stressful than being in debt? The never-ending string of phone calls and threatening letters from your creditors or collection agencies. Collection agencies are notorious for bullying consumers into paying up by relentlessly calling them at work and at home, posting on their social media, and in some cases, showing up on their doorstep.

If you’re being harassed by creditors about your outstanding debts, you can regain control of the situation with a few steps by educating yourself about your rights and taking the initiative to face your debts head-on.

Here are four helpful steps to stop collection calls and creditor harassment:

1. Identify Your Debts

First things first, you need to ensure the creditor or collection agency is contacting you for debts that actually belong to you. If your name is John Smith or another common name, there’s a possibility that they may be calling you about someone else’s account. In other situations, there could be a lack of communication between institutions and they might be calling you about debts you’ve already worked hard to eliminate.

It’s not uncommon for credit card companies and banks to sell off old debts they were unsuccessful in collecting to a debt collection agency. The files are pooled together and shipped over to the third-party company to recover the money. The information could be outdated, or nearing the statute of limitations, which is when creditors lose their right to enforce payment.

2. Educate Yourself About Your Rights

Aggressive debt collectors can be intimidating, and your best defense is knowledge. Read up on your rights so you know when a creditor is crossing the line.

Creditors are not allowed to use profanity, issue threats, or lose their temper when they call. They’re also not allowed to share details about your predicament with your loved ones or your employer.

There are also set times and protocol that debt collectors need to abide by. This includes how many times they can contact you within a day or a week, when they can contact you and if they can contact your employer at all.

Collection agencies can be sneaky! Take a careful look at any letters you receive – they may look like they’re official court documents or court orders to pay your debts. This is also illegal.

3. Take Action

There are certain actions you can take when the calls are getting to be too much, or they are infringing on your rights as a consumer.

Check to make sure the collection agency is licensed. If it isn’t, or if their jurisdiction doesn’t fall within your province, they don’t have any right to collect debts from you.

If they are legitimate but they’ve broken laws, report them to consumer protection authorities. It’s up to the authorities to revoke a collector’s license depending on what’s happened and if they’re a repeat offender.

Finally, you can stop the overwhelming phone calls by requesting in writing that debt collectors only communicate with you moving forward in writing. Laws around this vary according to province, but it’s typically called a “cease and desist” request.

4. Pay Back Your Debts

Once you’ve done all you can to get the creditor calls under control, it’s time to focus on paying back your debts.

You can tighten those purse strings, implement (and stick to!) a budget, cut down on your spending, work some overtime, pick up a second job and work hard to save up and pay off your debts in full.

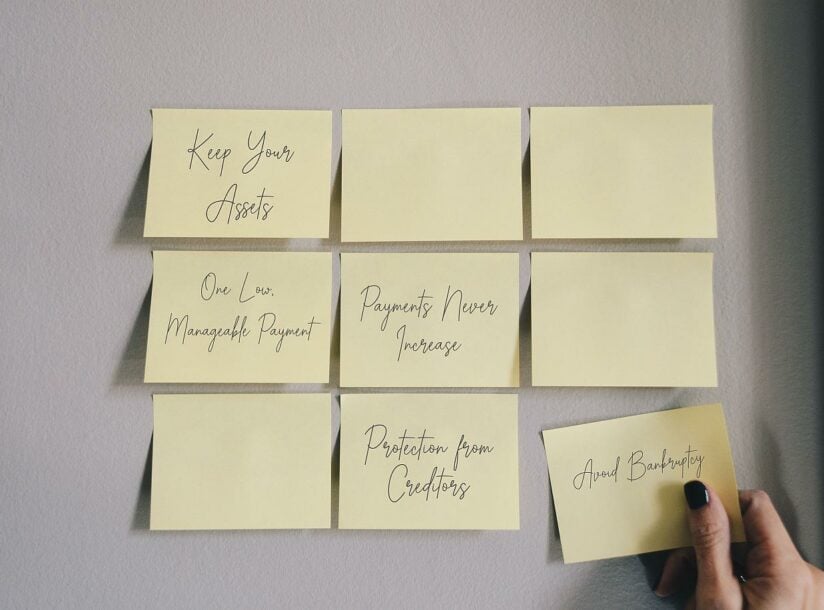

Alternatively, you can contact a Licensed Insolvency Trustee to discuss the other debt solution options available to you. One of the solutions a Trustee can provide you with is a consumer proposal. In this scenario, a Trustee negotiates with your creditors so that you only pay back a portion of your debts. Once you file, you are legally protected from creditor calls.

If you’re stressed to the max and want to put an end to collection calls but need some help, contact one of our trusted advisors at one of our 12 offices conveniently located throughout the Lower Mainland and Vancouver Island.