Five Advantages of Filing a Consumer Proposal in British Columbia

Filing for a consumer proposal is the number one alternative to personal bankruptcy in British Columbia. A consumer proposal allows you to settle your debts for less than what you owe by making a “deal” with your creditors and consolidating your debts into one manageable, interest-free monthly payment.

A consumer proposal can eliminate virtually all types of debt, including CRA debt and student loans. If you owe less than $250,000 (excluding your mortgage) and have a steady income, a consumer could be a great solution for you and your family. However, it’s very important to note that only a Licensed Insolvency Trustee can file a consumer proposal.

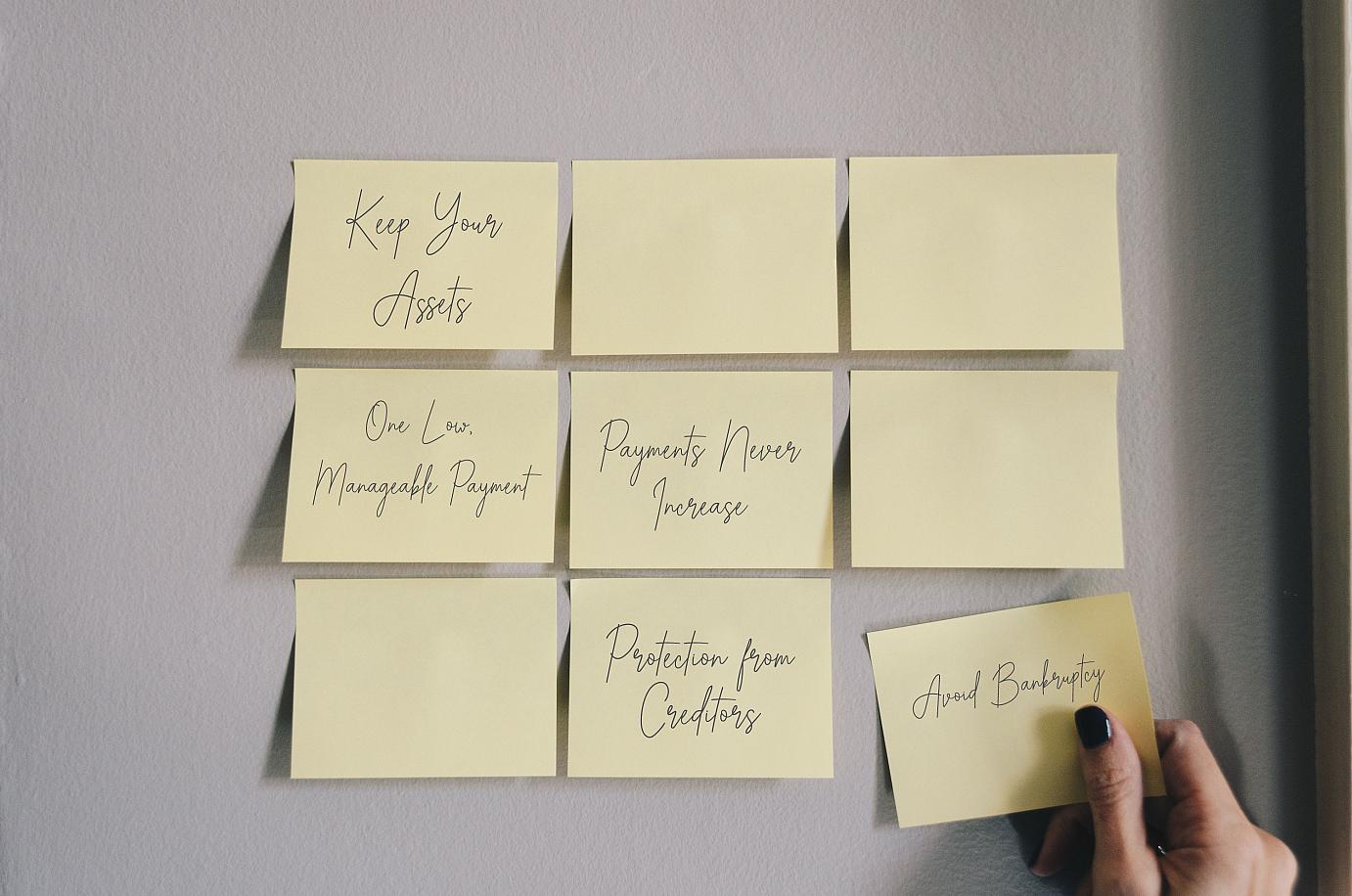

Advantages of a Consumer Proposal

Here’s why filing a consumer proposal is a great solution for many people, when compared to other debt-relief alternatives:

1. You Get to Keep Your Assets.

One of the biggest advantages of a consumer proposal is the fact that your assets are protected. You keep all assets in a proposal including any tax refunds, investments and equity in your home.

2. One Low, Manageable Monthly Payment.

In a consumer proposal, you negotiate to repay only a portion of your debt. It’s not unusual to see debts reduced by as much as 70% of the original amount owed. A consumer proposal is one of the best, and safest, debt consolidation options available. Interest stops during a consumer proposal, resulting in significant savings over a debt consolidation loan or second mortgage.

3. Your Payment Never Increases.

Unlike bankruptcy, where the more you earn the more you pay, consumer proposals have a fixed payment that never increases. If you expect your income to increase, consumer proposals are better than bankruptcy.

4. You Get Protection From Your Creditors (yes, even from the CRA).

As a legal process under the Bankruptcy & Insolvency Act, a consumer proposal provides creditor protection that will stop collection calls and wage garnishments. Once your consumer proposal is approved by the majority of your creditors, it’s binding for all creditors.

5. You Avoid Bankruptcy.

Many people need debt relief, but want to avoid filing bankruptcy. If you feel you would like to repay what you can, a consumer proposal is a safe alternative that you should discuss with a Licensed Insolvency Trustee. Creditors will generally accept your consumer proposal if you offer more than they would expect to receive in a bankruptcy.

Are There Disadvantages to Filing a Consumer Proposal?

There are some cons that you need to consider when filing for a consumer proposal, and this may not be the best option for everyone.

A consumer proposal will usually take longer to complete than a bankruptcy. By lowering your monthly payment through a consumer proposal, you are paying your creditors back over a longer period of time. However, if your financial situation improves, you can pay off a proposal early by increasing your payment and frequency or with a lump sum.

And of course, a consumer proposal does affect your credit rating – an R7 note (a note on your credit report that shows you’ve entered into an agreement to pay back your debt) will remain on your credit report for three years after completion. The R7 note is not desirable, but it’s still better than the R9 note given for a bankruptcy. And, chances are, you have a history of missing payments and you may already be unable to access credit due to a poor credit score. The good news is, it’s often possible to get a secured credit card during a consumer proposal, so you can start building your credit immediately after filing for a consumer proposal.

If it sounds like a consumer proposal is the right solution for you, the next step is to book a free consultation with one of our Licensed Insolvency Trustee. We are happy to meet with you to discuss your debt relief options in detail to ensure you are making the best decision for you and gain relief from any financial stress you may be experiencing.