- Home

- Port Alberni

- Bankruptcy in Port Alberni, BC

How to File for Bankruptcy in Port Alberni, BC

Filing for ankruptcy in BC is a legal process that allows individuals and businesses facing overwhelming financial difficulties to seek relief from their debts and make a fresh financial start.

In today’s complex financial landscape, individuals and businesses may find themselves facing overwhelming debt burdens that seem insurmountable. The bankruptcy process can offer a legal and regulated solution to address these financial challenges. Before making a decision, it’s best that you understand exactly what bankruptcy entails, how the bankruptcy process works, its advantages and disadvantages, along with viable alternatives. We also need to emphasize the importance of seeking guidance from licensed insolvency trustees and avoiding unlicensed debt consultants.

What is Bankruptcy?

Bankruptcy is a formal legal process designed to help individuals and businesses struggling with significant debt to obtain relief from their financial obligations. Bankruptcies are governed by the Bankruptcy and Insolvency Act (BIA) in Canada and can only be filed by a Licensed Insolvency Trustee.

How Bankruptcy Works

Filing for bankruptcy in Port Alberni, BC involves several steps:

Assessment: The first step is to book a free consultation with a licensed insolvency trustee (LIT) who will evaluate your financial situation and provide guidance on whether bankruptcy is the best option for you.

Prepare Documentation: If you decide to proceed with bankruptcy, your LIT will help you gather and complete the necessary paperwork, including a Statement of Affairs detailing your assets, liabilities, income, and expenses.

Assignment: You will sign the documents assigning your non-exempt assets to the trustee, who will sell them to repay creditors.

Stay of Proceedings: Once you file for bankruptcy, an automatic stay of proceedings is initiated, preventing creditors from pursuing legal actions against you and stopping collection agencies from contacting you.

Credit Counselling: You will need to attend two credit counseling sessions with a BIA Insolvency Counsellor. During these sessions you will learn about budgeting, saving for the future, and financial planning and goal setting.

Advantages of Bankruptcy

Debt Elimination: Bankruptcy allows you to eliminate most unsecured debts, giving you a fresh financial start.

Legal Protection: The automatic stay of proceedings protects you from creditor harassment, wage garnishments, and legal actions.

Structured Process: Bankruptcy provides a structured framework to manage and resolve your debt situation under the supervision of a Licensed Insolvency Trustee.

Disadvantages of Filing for Bankruptcy

Credit Impact: Bankruptcy will adversely affect your credit score and remain on your credit report for six to seven years after you’ve been discharged, impacting your ability to secure credit.

Asset Liquidation: Some assets may be sold to repay creditors.

Public Record: Bankruptcy is a matter of public record, which could affect your reputation and impact certain career choices.

Alternatives to Bankruptcy

Before proceeding with bankruptcy, consider these alternatives:

Consumer Proposal: A formal offer to creditors to repay a portion of your debt over an extended period.

Debt Consolidation: Combining multiple debts into a single, manageable payment.

Credit Counselling: Seeking advice from credit counselors to develop a debt management plan.

Negotiating with Creditors: Directly negotiating with creditors to modify repayment terms.

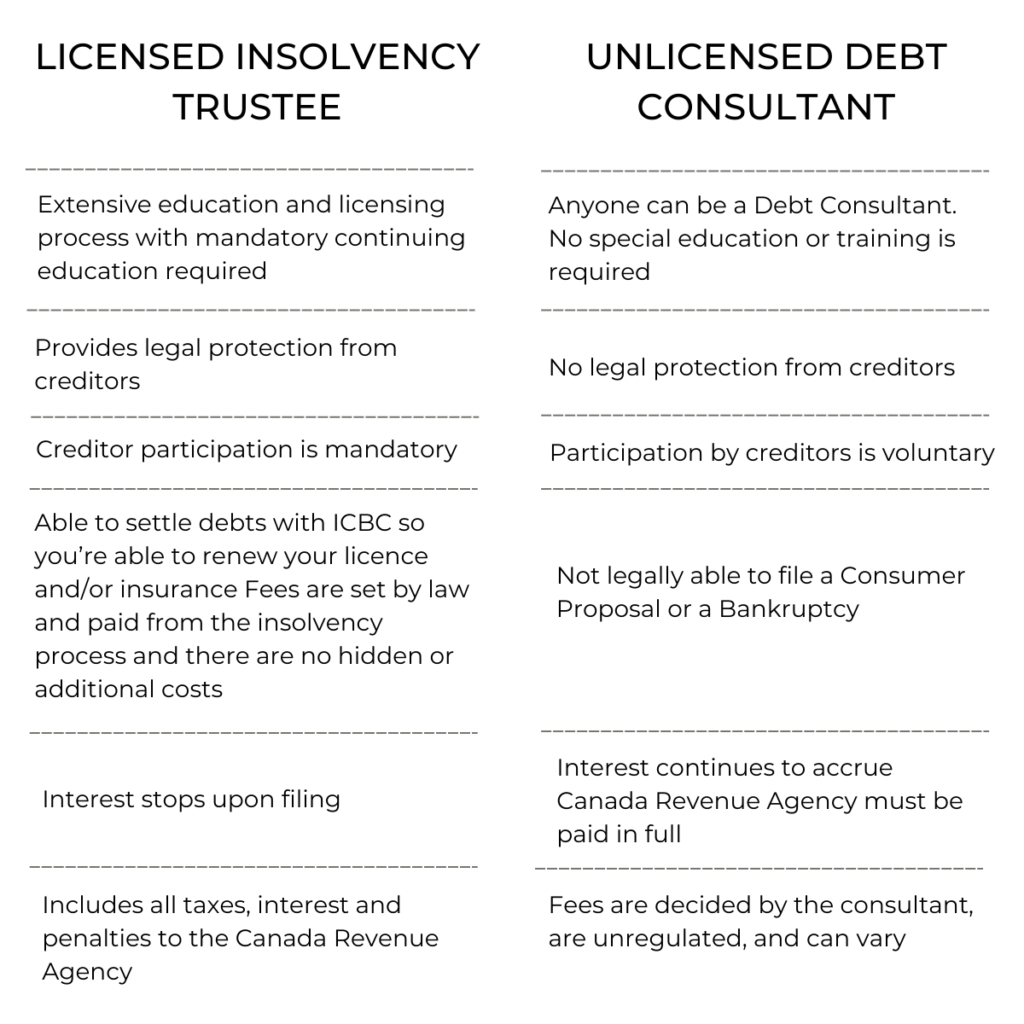

Licensed Insolvency Trustees vs. Unlicensed Debt Consultants

Choosing a local licensed insolvency trustee in Port Alberni, BC is crucial for a reliable and regulated bankruptcy process. Licensed trustees are authorized by the Office of the Superintendent of Bankruptcy (OSB) and are equipped with the knowledge and expertise to guide you through the process. They offer ethical and transparent services while adhering to strict professional standards.

In contrast, unlicensed debt consultants lack the legal authority and oversight to provide accurate and trustworthy advice. Entrusting your financial future to an unlicensed consultant can lead to misinformation, costly upfront fees, financial exploitation, and potentially worsen your situation.

Book Your Free Consultation with a Licensed Insolvency Trustee

Filing for bankruptcy in Port Alberni, BC is a structured legal process that offers relief to individuals and businesses burdened with unmanageable debt. While bankruptcy has its advantages and disadvantages, exploring alternative options and seeking guidance from licensed insolvency trustees are essential steps to making informed decisions about your financial future. Always remember that choosing a licensed professional ensures a secure and lawful path toward resolving your debt issues. Book for free debt consultation now.