Life doesn’t always go according to plan, and sometimes financial difficulties can hit us hard. If you’re finding yourself drowning in debt and struggling to make ends meet in Penticton, BC, it might be time to consider the bankruptcy process. Don’t worry, you’re not alone, and there are steps you can take to regain control of your financial situation.

What is Bankruptcy?

Bankruptcy is a legal process designed to help individuals and businesses who are unable to repay their debts. It offers a fresh start by eliminating most of your debts and giving you a chance to rebuild your financial life. In Penticton, BC, as in the rest of Canada, bankruptcy is governed by federal laws, specifically the Bankruptcy and Insolvency Act.

How to File for Bankruptcy

Filing for bankruptcy might seem like a daunting task, but it can be a life-changing decision that helps you get back on your feet. Here’s a simplified breakdown of the process:

Assessment: Begin by assessing your financial situation. Understand your debts, assets, and income to determine if bankruptcy is the right path for you.

Licensed Insolvency Trustee (LIT): Reach out to a Licensed Insolvency Trustee in Penticton. These professionals are authorized by the government to administer bankruptcy proceedings.

Free Debt Relief Consultation: Your Trustee will provide guidance and assess your situation. They will explain the bankruptcy process, its implications, and alternative options, such as a consumer proposal.

Filing for Bankruptcy: If you decide to proceed with bankruptcy, your LIT will help you prepare the necessary documents and file them with the Office of the Superintendent of Bankruptcy (OSB).

Stay of Proceedings: Once you file for bankruptcy, an automatic stay of proceedings is initiated. This prevents your creditors from taking legal action against you to collect debts and stops those harrassing collection calls.

Asset Surrender: Depending on your situation, you might need to surrender certain non-exempt assets. However, exemptions exist to protect essential items like clothing and household goods. Your Trustee will be able to explain to you which assets are exempt when you file for bankruptcy in Penticton, BC.

Surplus Income Payments: If your income exceeds a certain threshold set by the Office of the Superintendent of Bankruptcy, you might be required to make surplus income payments during your bankruptcy.

Financial Counselling: You must participate in two mandatory financial counseling sessions to help you develop better money management skills.

Discharge from Bankruptcy: Typically, bankruptcy lasts for about nine months for first-time bankrupts. Once you complete your duties, you’ll receive a Certificate of Discharge, freeing you from all debts that were included in your bankruptcy.

Advantages and Disadvantages of Bankruptcy

Advantages of Filing for Bankruptcy

Debt Relief: Bankruptcy wipes out most of your debts, giving you a fresh start.

Protection From Creditors: The automatic stay of proceedings protects you from creditor actions.

Some Asset Protection: There are some assets that are exempt from your bankruptcy.

Professional Guidance: Licensed Insolvency Trustees provide expert advice and ensure your rights are upheld.

Disadvantages of Filing Bankruptcy

Credit Impact: Bankruptcy stays on your credit report for six or seven years, depending on the credit bureau. This can affect your ability to obtain credit during and after you’ve completed your bankruptcy.

Asset Surrender: You might lose certain non-exempt assets.

Public Record: Bankruptcy is a public legal proceeding.

Consumer Proposal vs. Bankruptcy: What’s the Difference?

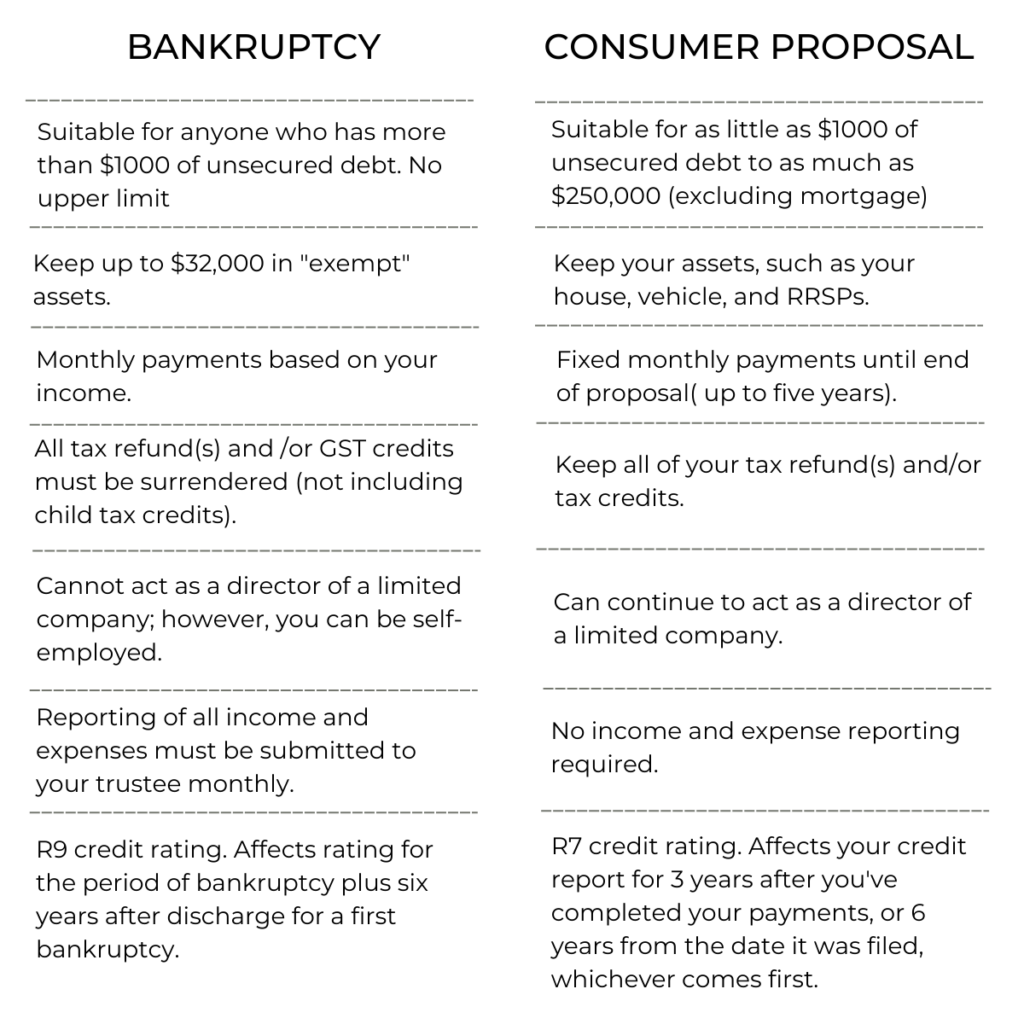

A consumer proposal is an alternative to bankruptcy that involves negotiating a repayment plan with your creditors. It allows you to keep your assets and make affordable monthly payments. However, if your income is low and you don’t have assets to protect, bankruptcy might be the better option.

Choosing a Licensed Insolvency Trustee in Penticton, BC

When considering bankruptcy in Penticton, always work with a local Licensed Insolvency Trustee. Trustees have the expertise and authority to guide you through the process while ensuring your rights are protected. Avoid unlicensed debt consultants, as they charge costly upfront fees, do not have the necessary qualifications, and probably not have your best interests at heart.

Book Your Free Debt Consultation

Remember, facing financial difficulties doesn’t define you, and seeking help is a sign of strength. The bankruptcy process can be a challenging journey, but it’s a pathway to a brighter financial future. Reach out to a Licensed Insolvency Trustee in Penticton to take the first step toward regaining control of your finances and your life.