When you file for bankruptcy in Nanaimo BC, as in the rest of Canada, the process follows a well-defined structure aimed at providing relief to those struggling with overwhelming debt. Let’s discuss what exactly bankruptcy entails, the steps to file for bankruptcy, its advantages and disadvantages, the differences between a consumer proposal and bankruptcy, and the importance of working with a licensed insolvency trustees.

Understanding Bankruptcy

Bankruptcy is a legal status wherein an individual or business declares their inability to meet their financial obligations. It’s a legal process regulated by the Bankruptcy and Insolvency Act in Canada. When filing for bankruptcy, a licensed insolvency trustee is appointed to administer the process and distribute the debtor’s assets among creditors.

Filing for Bankruptcy in Nanaimo, BC: Steps and Requirements

Assess Your Financial Situation: To file for bankruptcy, you must be insolvent, meaning your liabilities exceed your assets and you’re unable to pay your debts as they become due. Consulting a licensed insolvency trustee is crucial to determine your eligibility.

Free Consultation with a Licensed Insolvency Trustee: Licensed insolvency trustees are the only professionals authorized by the federal government to assess your financial situation, explain your options, guide you through the process, and ultimately file your bankruptcy. In Nanaimo, BC, seeking a licensed trustee is vital due to their education, standards, and knowledge of local regulations.

Documentation: You’ll need to provide comprehensive financial information, including your debts, assets, income, and expenses. This information helps the trustee understand your situation and create a tailored debt relief plan.

Filing Bankruptcy: Once you’ve provided the necessary documents, your trustee will file the bankruptcy paperwork with the Office of the Superintendent of Bankruptcy (OSB). This triggers an automatic stay of proceedings, which stops creditors from calling and pursuing legal actions against you.

Asset Surrender: Non-exempt assets may be sold to repay creditors. In BC, certain assets, like primary residences with equity up to a certain limit, are exempt from seizure. Your Licensed Insolvency Trustee in Nanaimo, BC can explain to you the assets you’re able to keep and which assets are not exempt from your bankruptcy.

Surplus Income Payments: If your total income exceeds a predetermined threshold, set by the Government of Canada, you may be required to make something called a “surplus income payment” during the bankruptcy period.

Financial Counselling: During your bankruptcy, you are required to complete two financial counselling sessions with a Qualified Insolvency Counsellor. These sessions promote responsible money management and help you to secure a solid financial future.

Bankruptcy Discharge: Typically, the bankruptcy process lasts for nine months for first-time bankruptcies with no surplus income. When you’ve completed all requirements of your bankruptcy you will receive your Certificate of Discharge, all debts included in your bankruptcy are eliminated, and you are granted a fresh financial start.

Advantages of Filing for Bankruptcy

Debt Relief: Bankruptcy eliminates most unsecured debts, freeing you from the burden of overwhelming financial obligations.

Fresh Start: Bankruptcy offers a chance to rebuild your financial life without the constant pressure of debt.

Creditor Protection: Creditors are prohibited from pursuing further legal action against you and collection calls stop.

Disadvantages of Bankruptcy

Credit Impact: Your bankruptcy will remain on your credit report for up to seven years (depending on the credit bureau) and this affects your creditworthiness.

Asset Surrender: Non-exempt assets might be sold to repay creditors.

Limited Borrowing: Securing credit post-bankruptcy might be challenging, and if available, interest rates may be higher.

Consumer Proposal vs. Bankruptcy

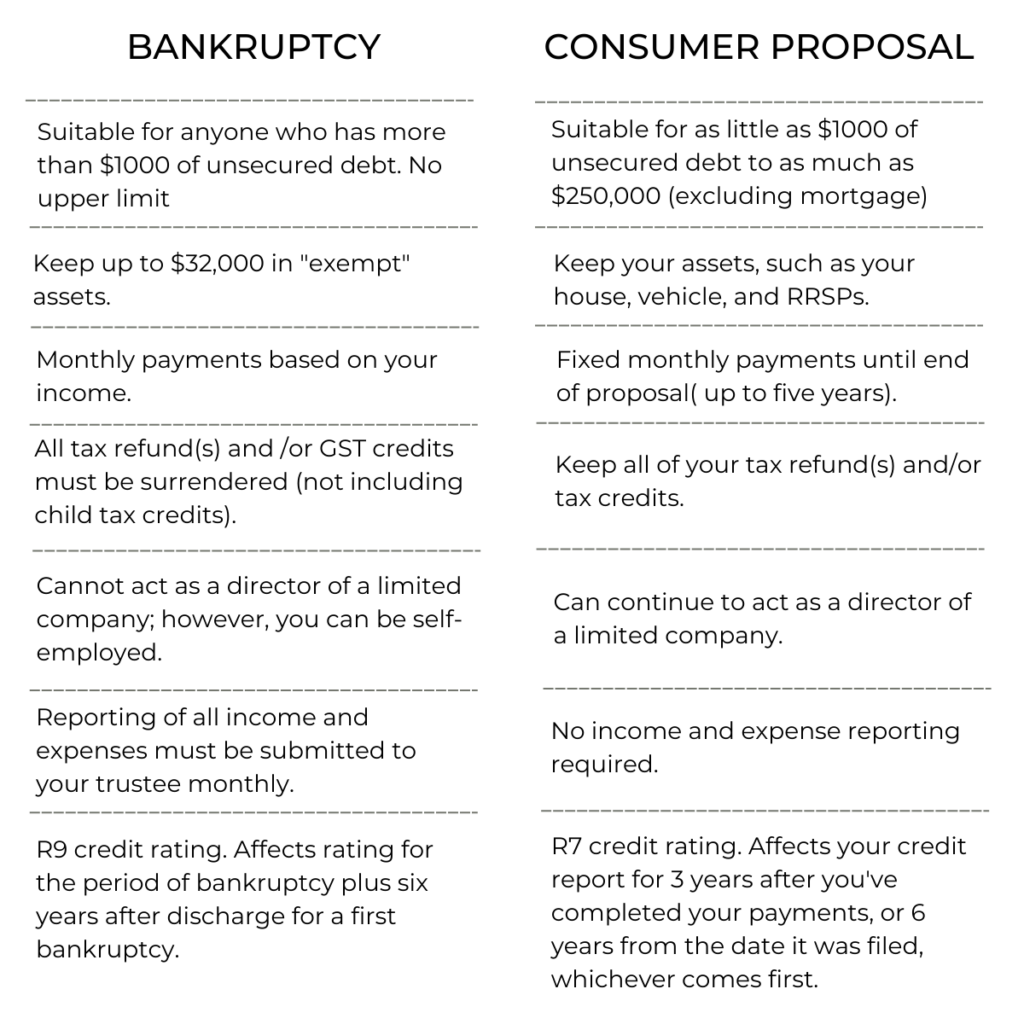

A consumer proposal is an alternative to bankruptcy, allowing you to negotiate with creditors to repay a portion of your debts over an extended period. It has advantages such as a shorter credit report impact and potential asset retention, but it requires creditor approval and might involve larger overall payments.

The Role of a Licensed Insolvency Trustee

Licensed insolvency trustees are professionals authorized by the OSB to guide individuals and businesses through the bankruptcy process. They ensure proper legal procedures are followed, protect your rights, and provide expert advice tailored to your situation. Working with a licensed trustee in Nanaimo, BC is essential for complying with local laws and regulations.

The Risks of Working With Unlicensed Debt Consultants

Unlicensed debt consultants lack the legal authority to administer bankruptcy proceedings. Seeking their advice could result in costly fees, a lengthy process, incomplete or incorrect filings, legal complications, and potential financial exploitation. To ensure a smooth and legitimate bankruptcy process, always engage the services of a licensed insolvency trustee.

Book Your Free Debt Relief Consultation

Understanding the bankruptcy process in Nanaimo, BC, involves assessing eligibility, working with a licensed insolvency trustee, and navigating the steps with expert guidance. Bankruptcy offers both advantages and disadvantages, and considering alternatives like consumer proposals is essential. Book your free consultation with a licensed trustee now to discuss your options and get the fresh start you deserve.