In Langley, BC, as in the rest of Canada, bankruptcy is governed by federal laws. The process of filing for bankruptcy involves several steps.

Understanding Bankruptcy

Consultation: Begin by seeking the guidance of a licensed insolvency trustee (LIT). These professionals specialize in helping individuals and businesses navigate their financial challenges. They’ll assess your financial situation, discuss your options, and determine if bankruptcy is the right choice for you.

Pre-filing Requirements: You’ll need to provide detailed information about your debts, assets, income, and expenses. Your LIT will use this information to prepare the necessary documentation.

Filing Documents: Your Trustee will help you complete the necessary paperwork and file the bankruptcy documents with the Office of the Superintendent of Bankruptcy (OSB).

Stay of Proceedings: Once your bankruptcy is filed, an automatic stay of proceedings will take effect, which means your creditors must stop all collection activities and legal action.

Surrendering Assets: Depending on your situation, you may need to surrender some assets to your LIT, who will then sell them to repay your creditors.

Credit Counseling: During your bankruptcy, you must complete two credit counseling sessions with a Qualified Insolvency Counselor. These sessions aim to help you better manage your money and set short and long-term financial goals.

Discharge: After a specified period, usually nine months for first-time bankruptcies, you will be discharged from bankruptcy. This means most of your debts will be eliminated, allowing you to start fresh.

Advantages and Disadvantages of Filing for Bankruptcy

Advantages

- Relief from overwhelming debt.

- Freedom from creditor harassment.

- Fresh start to rebuild your financial life.

- Protection of certain assets through exemptions.

Disadvantages

- Impact on your credit score.

- Some assets may be sold to repay creditors.

- Potential stigma associated with bankruptcy.

- Limited access to credit during bankruptcy.

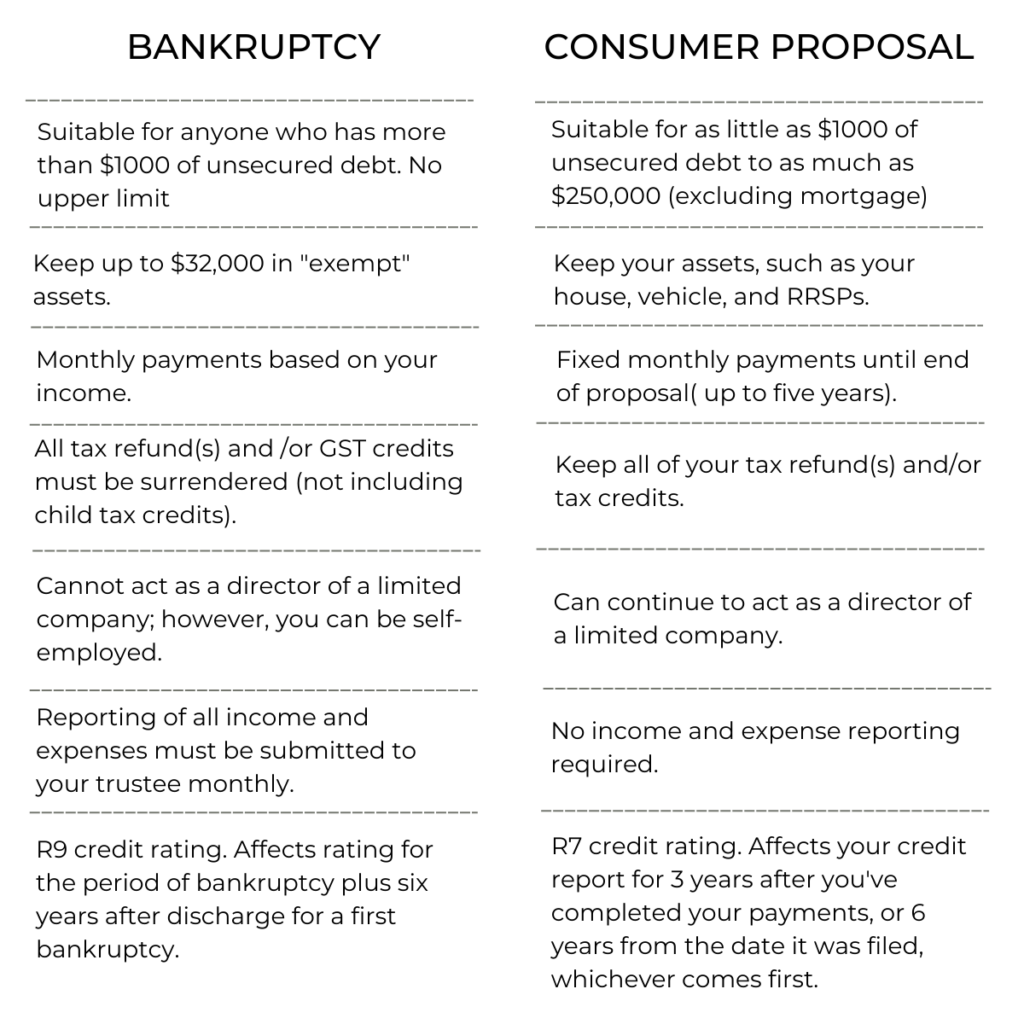

Bankruptcy vs. Consumer Proposal

A consumer proposal is an alternative to bankruptcy. It’s a legally binding arrangement between you and your creditors, facilitated by a licensed insolvency trustee. In a consumer proposal, you negotiate to repay a portion of your debts over an extended period, usually up to five years. While it allows you to avoid full bankruptcy, it might not be suitable for everyone, and its acceptance depends on creditor approval.

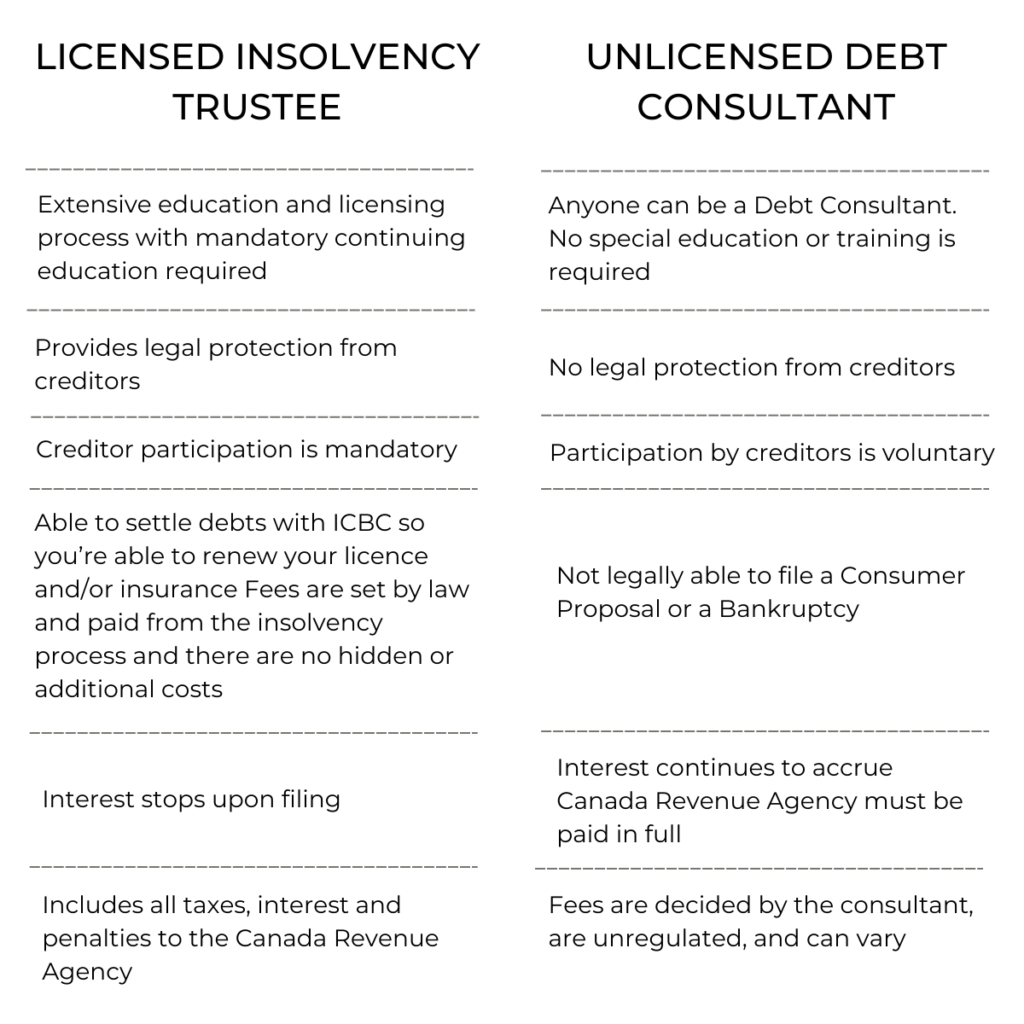

The Importance of Licensed Insolvency Trustees

Licensed Insolvency Trustees (LITs) are the only professionals in Canada with the legal authority to facilitate bankruptcies and consumer proposals. Seeking help from an LIT is crucial for several reasons:

Expert Guidance: Trustees are knowledgeable professionals who can provide tailored advice based on your unique situation.

Legal Protection: Working with an LIT ensures that your rights are protected throughout the bankruptcy process.

Trustee Oversight: LITs are regulated by the OSB and adhere to strict ethical and professional standards.

Avoiding Unlicensed Debt Consultants

Unlicensed debt consultants or advisors may promise quick fixes but often lack the expertise and oversight that licensed insolvency trustees provide. They might charge high fees for services that don’t meet legal requirements or deliver the promised results. To ensure your financial well-being, always choose a licensed and reputable professional.

Filing for bankruptcy in Langley BC, can provide much-needed relief to individuals facing insurmountable debt. It’s a process that offers both advantages and disadvantages, but it’s essential to approach it with the guidance of a licensed insolvency trustee. Remember that you have options beyond bankruptcy, such as a consumer proposal, and your trustee will help you make the best decision for your financial future. Book your free consultation now with a licensed insolvency trustee to discuss your options.