Life can sometimes throw unexpected financial challenges our way, leaving us feeling overwhelmed and uncertain about our future. If you find yourself drowning in debt and unable to make ends meet, filing for bankruptcy might be a solution worth considering. Understanding the ins and outs of filing for bankruptcy in Kamloops, BC, its pros and cons, and the alternatives to bankruptcy is essential to making an informed decision about your financial future.

What is Bankruptcy?

Bankruptcy is a legal process designed to help individuals or businesses overwhelmed by debt to gain a fresh financial start. It involves a declaration that you are unable to repay your debts as they become due. In Kamloops, as elsewhere in Canada, filing for bankruptcy is governed by the Bankruptcy and Insolvency Act.

Bankruptcy Pros and Cons

Pros

Debt Relief: Bankruptcy provides a pathway to eliminate your unsecured debts, giving you a chance to start fresh without the burden of unmanageable financial obligations.

Legal Protection: Once you declare bankruptcy, creditors are legally prohibited from contacting you or pursuing legal actions against you to collect debts.

Interest Stops: When you file for bankruptcy, the interest accumulating on your debts immediately stops.

Financial Education: One of the requirements of the bankruptcy process is to attend two financial counselling session with a Certified Insolvency Counselor. During these sessions you will to learn money management skills and learn how to financially plan to avoid future debt troubles.

Cons

Credit Impact: Filing for bankruptcy will have a negative impact on your credit score, making it harder to obtain credit in the immediate aftermath.

Loss of Assets: Some of your assets may be sold to repay creditors. However, there are exemptions that vary by province, and a licensed insolvency trustee in Kamloops, BC can walk your through what assets you can keep if you file for bankruptcy.

Public Record: A bankruptcy filing is a matter of public record and might impact your financial reputation and limit you from working in certain careers.

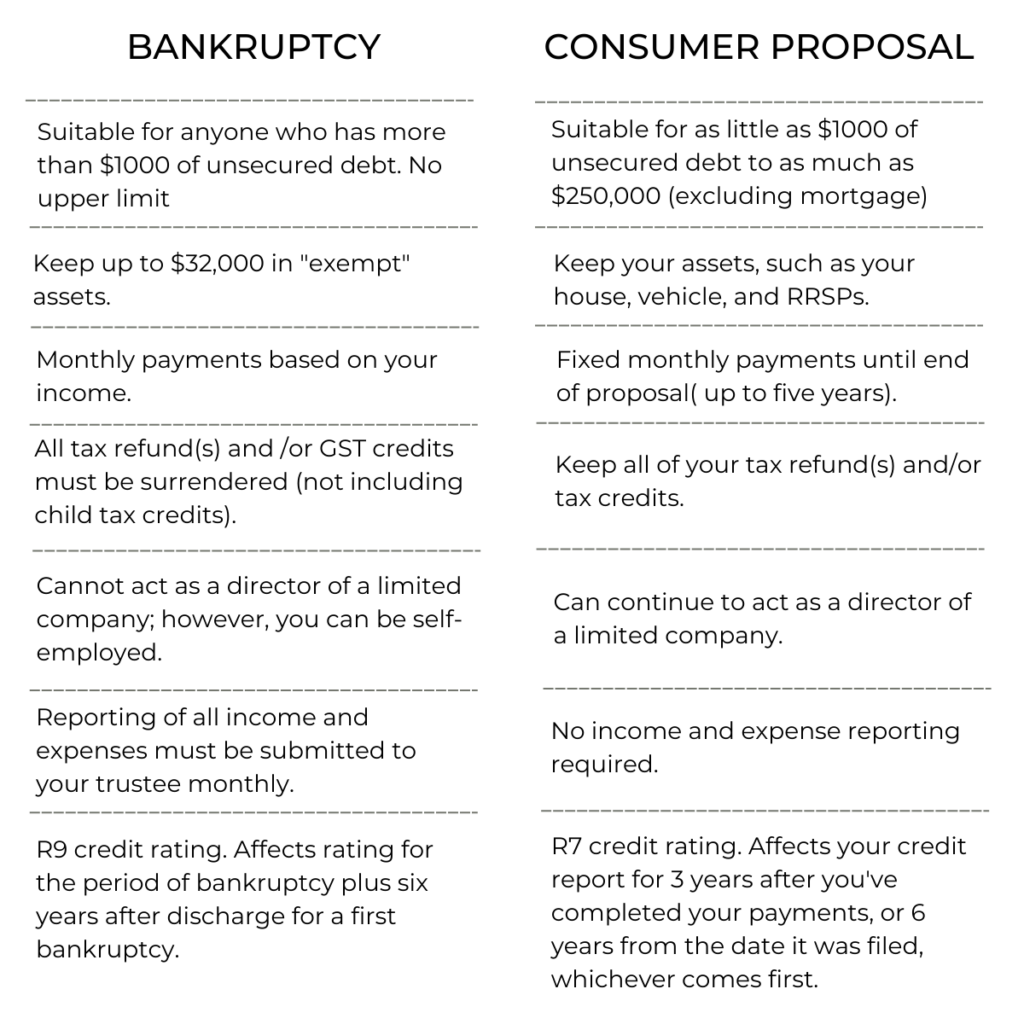

Bankruptcy vs. Consumer Proposals

A consumer proposal is an alternative to bankruptcy. It’s a legally binding agreement between you and your creditors, facilitated by a licensed insolvency trustee (LIT). In a consumer proposal, you negotiate to repay a portion of your debts over a set period, usually up to five years. Unlike bankruptcy, your assets are protected and you can maintain more control over your financial affairs.

What Assets Can You Keep in a Bankruptcy BC?

British Columbia has specific exemptions that allow you to keep certain assets even if you file for bankruptcy. These might include:

Necessary Clothing: Your clothing is generally exempt from seizure.

Household Furnishings: Essential household items like furniture and appliances may be exempt up to a certain value.

Tools of the Trade: Tools required for your profession or trade within certain limits could be exempt.

Vehicle: A vehicle may be exempt up to a specific value.

Certain Pensions: Registered retirement savings plans (RRSPs) and pension plans might be protected to some extent.

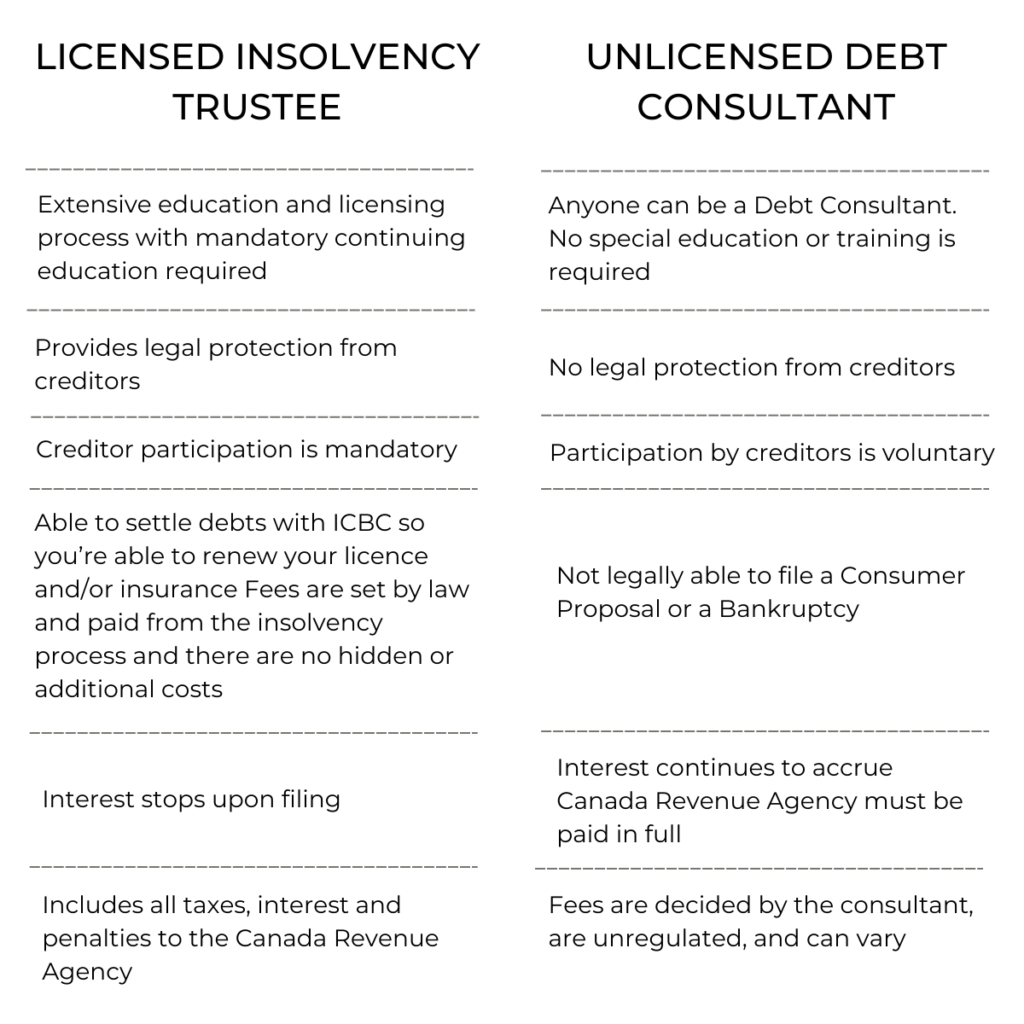

Licensed Insolvency Trustee vs. Unlicensed Debt Consultants

When dealing with financial distress, it’s crucial to seek help from a licensed insolvency trustee (LIT). A LIT is a federally regulated professional who can provide you with accurate information about bankruptcy and alternatives to bankruptcy. Trustees have the expertise to guide you through the process, ensuring your rights are protected.

On the other hand, unlicensed debt consultants lack the legal authority and professional training that licensed trustees possess. Relying on them might lead to upfront fees, incorrect advice, legal complications, and ultimately, a worsened financial situation.

Finding a licensed insolvency trustee in Kamloops BC is the best way to ensure you’re receiving reliable advice tailored to your unique situation. They can help you explore all options available to regain financial stability.

Filing for bankruptcy in Kamloops BC, is a significant decision that comes with both benefits and drawbacks. Understanding the process, exemptions, and alternatives like consumer proposals is vital to making the right choice for your financial well-being. Remember, reaching out to a licensed insolvency trustee is the first step toward finding a viable solution to your debt challenges while avoiding the pitfalls of unlicensed debt consultants. Your journey to financial recovery begins with informed choices and the right support. Book your free consultation with a Licensed Insolvency Trustee now.