- Home

- Fort St. John

- Bankruptcy in Fort St. John

Filing for Bankruptcy in Fort St. John

Bankruptcy is a legal process designed to give individuals and businesses a fresh financial start when they are overwhelmed by debts that they cannot repay.

If you find yourself drowning in debt, struggling to make ends meet, and facing creditor pressures, it might be time to consider your options, and one of them is filing for bankruptcy. Let’s walk through the process, weigh the pros and cons, and explore alternatives like consumer proposals. We can’t emphasize enough the importance of seeking professional guidance from a licensed insolvency trustee.

While bankruptcy is not a decision to be taken lightly, it can provide relief from unmanageable financial burdens and allow you to rebuild your financial life. The bankruptcy process and Licensed Insolvency Trustees operate under Canadian federal law and is governed by the Bankruptcy and Insolvency Act.

How Bankruptcy Works in British Columbia

- Filing for Bankruptcy: Individuals or businesses facing financial difficulties can voluntarily file for bankruptcy through a Licensed Insolvency Trustee (LIT). The LIT is a licensed professional who specializes in helping individuals and businesses navigate the bankruptcy process.

- Automatic Stay of Proceedings: Once bankruptcy is filed, an automatic stay of proceedings is initiated. This means that creditors are prohibited from taking legal action to collect debts, such as garnishing wages or seizing assets.

- Liquidation of Assets: In a personal bankruptcy, non-exempt assets may be sold by the LIT to repay creditors. Exempt assets are protected up to certain limits, which vary by province or territory. When you consult with a Trustee, they will let you know what’s exempt if you’re filing in Fort St. John, BC.

- Discharge from Bankruptcy: After a certain period of time, as long as the individual complies with the requirements of the bankruptcy process, all eligible unsecured debts can be discharged. This means the individual is no longer legally obligated to repay those debts.

- Credit Counseling and Financial Education: When someone files for bankruptcy, they are required to attend to insolvency counseling sessions to help them better manage their money and make informed financial decisions in the future.

- Surplus Income Payments: In some cases, individuals with higher incomes may be required to make surplus income payments during the bankruptcy period to contribute more to their debt repayment.

- Credit Consequences: While bankruptcy offers a way out of debt, it also has consequences for credit ratings. A bankruptcy will remain on the individual’s credit report for up to 7 years after completing their bankruptcy.

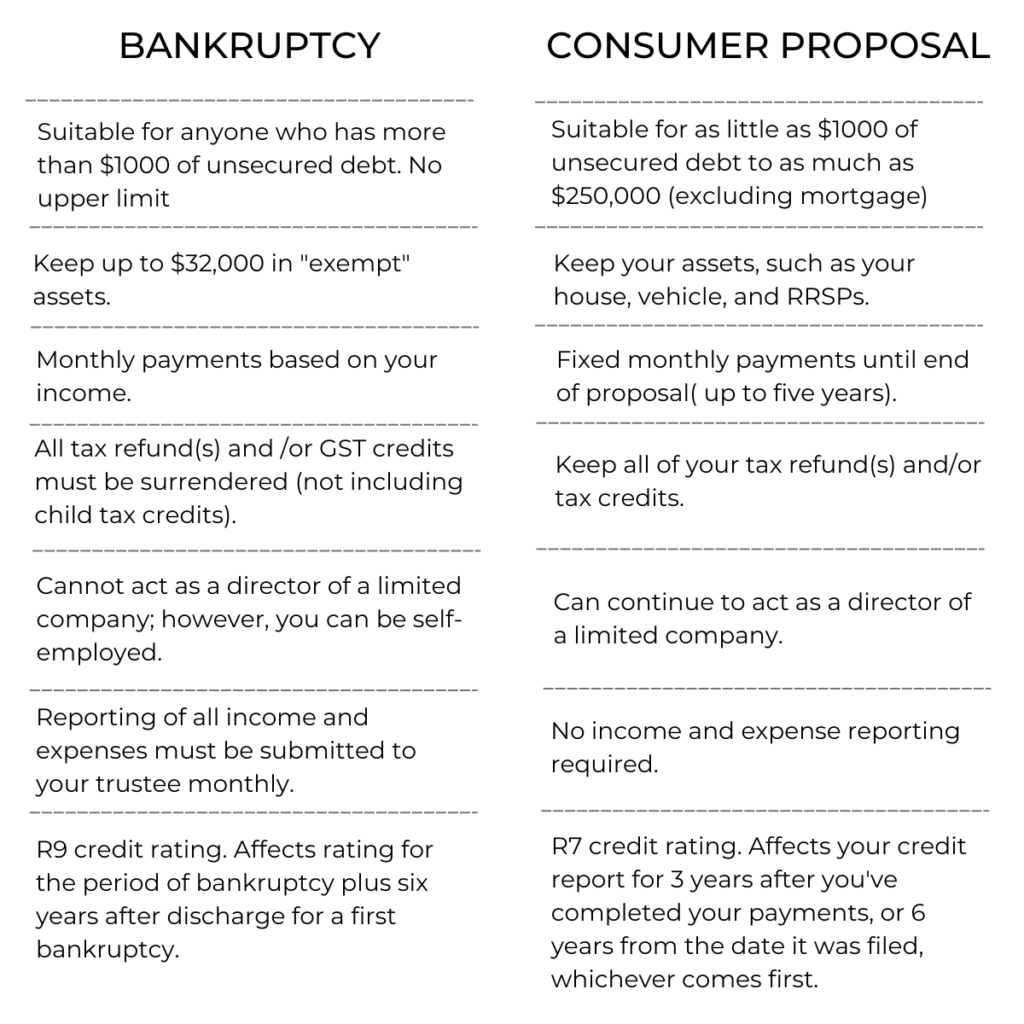

- Alternatives to Bankruptcy: For individuals in Canada, there are alternatives to bankruptcy, such as a consumer proposal. A consumer proposal is a legally binding arrangement to repay a portion of the debt over time.

It’s important to note that bankruptcy laws and regulations may change, and the specifics of the process can vary based on individual circumstances and the province or territory in which you reside. If you’re considering bankruptcy as an option, it’s important that you consult with a Licensed Insolvency Trustee to help you understand the best course of action for your specific financial situation.

Consumer Proposal vs. Bankruptcy: Weighing Your Options

What Can You Keep in a Bankruptcy in British Columbia?

British Columbia has specific exemptions that determine what assets you can keep during a bankruptcy. These exemptions are designed to allow individuals to maintain a basic standard of living. Exempt assets can include essential household items, a certain amount of equity in your home or vehicle, and certain tools necessary for your occupation. When you consult with a Licensed Insolvency Trustee, they will be able to go over this list in detail with you to ensure you understand which assets are protected and which assets would be subject to seizure.

The Vital Role of a Licensed Insolvency Trustee

When decided whether you should file for bankruptcy, it’s crucial to seek guidance from a licensed insolvency trustee (LIT). An LIT is the only licensed professional who is authorized by the government to administer bankruptcy and insolvency proceedings. They provide expert advice, help you understand your options, and ensure that the process is carried out according to the law. Always opt for a licensed trustee to protect your interests.

Avoid Unlicensed Debt Consultants

Unlicensed debt consultants might promise quick fixes and easy solutions to your financial woes, but beware. These consultants will charge hefty, upfront fees and lack the necessary qualifications needed to file your bankruptcy for you. Seek advice from an unlicensed debt professional also puts you at risk of falling into scams or financial schemes that exacerbate your situation. Always choose a licensed insolvency trustee who is regulated by the government and follows ethical practices.

Facing financial challenges can be overwhelming, but remember that you’re not alone. By understanding the ins and outs of bankruptcy, exploring alternatives, and seeking guidance from a licensed insolvency trustee, you can pave the way to a brighter financial future. Remember, your journey to financial recovery starts with informed decisions and a supportive team by your side.